4. Secret Insights and Answers¶

In this chapter you will find answers to most frequently asked questions.

4.1. How often does AI for Gold trade?¶

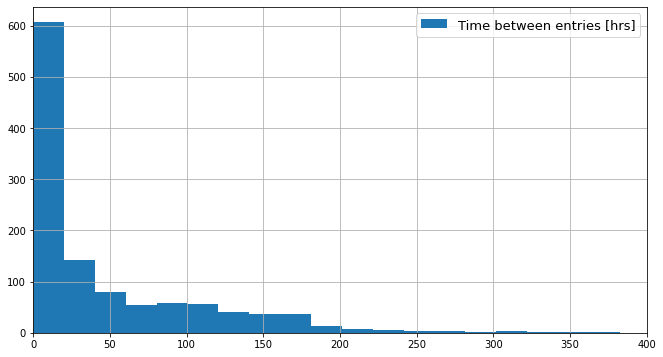

Simple answer: 3-4 times a week. More elaborated answer: It depends on the market. Below, you can see a histogram extracted from the backtest results. On its horizontal axis it shows the amount of hours passing between two consecutive entries. In only a few cases 400 hours (=16 days) are observed.

Note

This means, in some market conditions it can take up to 16 days between two trades.

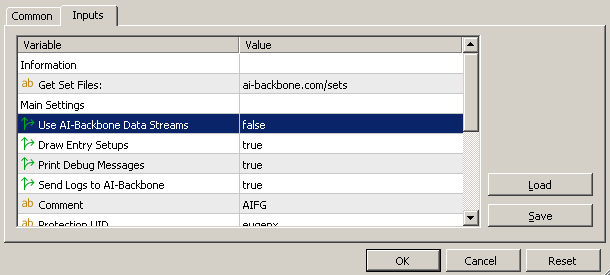

In some cases the used AI-Data may be more restrictive than the original price data from your broker. You might get better results by disabling AI-data stream (see image below). But please run a backtest before doing so to be sure, that the EA works well with the original data from your broker. Here is how you can disable AI-data stream from the EA inputs:

There is a nice quote from Warren Buffet:

4.2. What position sizes are to expect?¶

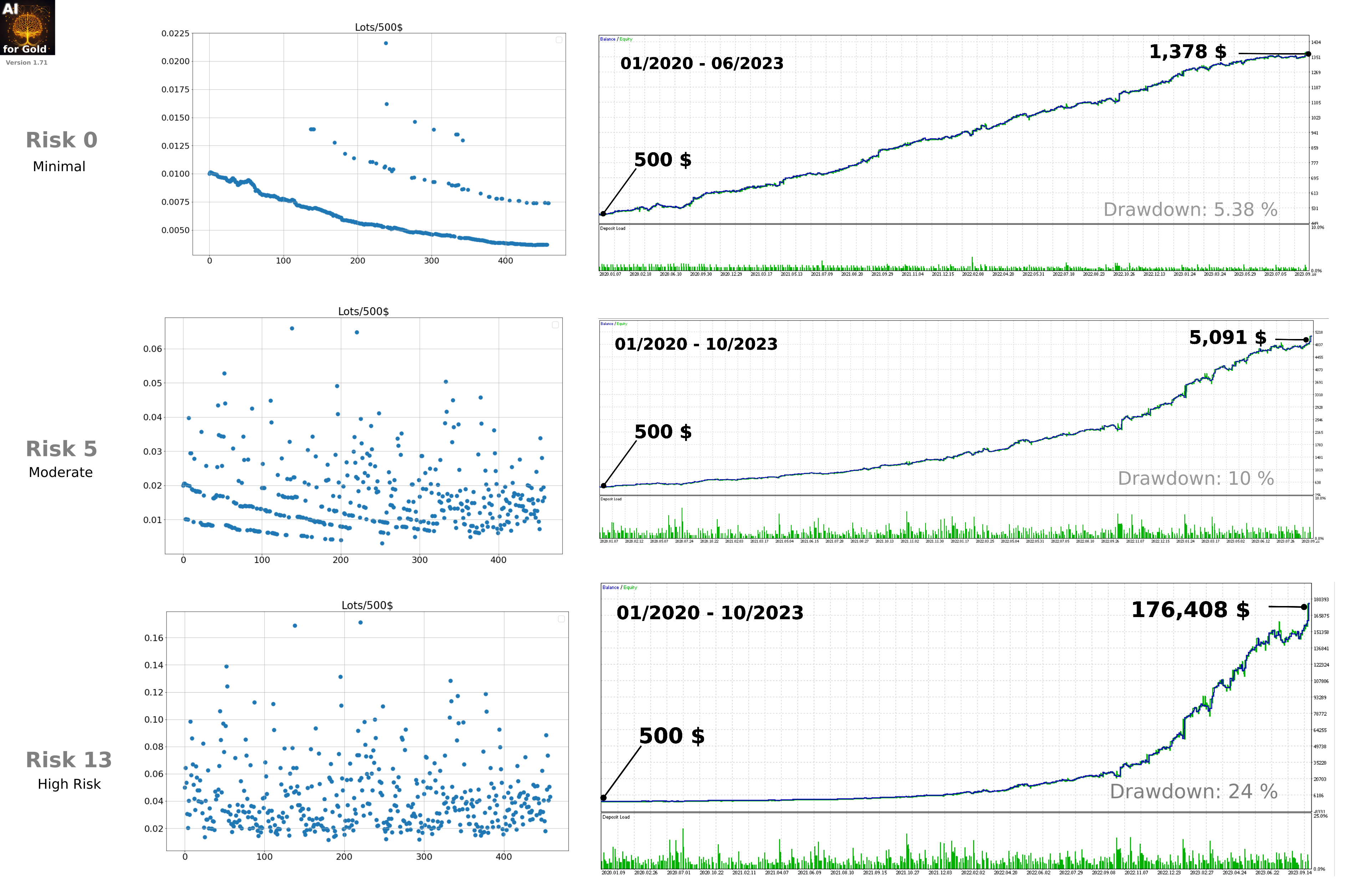

Depending on your risk setting, you will encounter different position sizes.

The analysis above comprises the distribution of lot sizes over different risk levels. The scatter plots on the left show single position sizes per 500$. If you see a value of 0.01/500$, that means that on a 1000$ account, this would have been a position of 0.01 lots. As of risk level 13, there are quite a few with 0.25/500$. This means, that these position would have been 0.5 lots on a 1000$ account or 5 lots on a 10,000$ account. All analysis has been carried out on an account with leverage 1:500.

4.3. How to use AI for Gold with low leverage like 1:30?¶

The answer here will rely on the position size discussion above. Let’s assume you have an account of 10,000$ with leverage of 1:30. What margin allocation is to be expected and how to choose the Multiplier Input Parameter?

Looking at risk13 statistics from above, max lot size was 0.25 lots per 500$. Let’s further assume that you have an account with 10,000$. Then the lot size will be 5 lots. The EA opens sometimes 2 positions of similar size into same direction, which makes it 10 lots in total. 10 lots will require a margin of 64,800$ on a leverage of 1:30.

But the total margin requirements of a single trade must not be larger than 30% or your account. Otherwise the broker will be eager to execute margin call.

So we need a multiplier m to match \(3000\$ = m \cdot 64,800\$\). Thus the multiplier m will be \(m = \frac{3000}{64800} = 0.046\) and the max position size for the EA will be 0.46 lots.

Note

- If you would like to compute this on your own with your leverage and risk level, here are the steps:

Select the risk level from the image above and see the max lot size from the scatter plot on the left. Multiply the value with \(k=2\frac{\text{your account}}{500}\) in order to get the total lot size of two positions on your account.

Use MyFxBook Calculator to estimate the margin requirements with your broker leverage.

Find the multiplier \(m\) so the max lot size is no larger than 30% of your account margin.

In case you would like to have a coarse estimation quickly, just use the interactive calculator below. 🙂

4.4. Interactive Risk Calculator¶

4.5. Does AI for Gold work on non-USD$ accounts?¶

Yes! After version 1.69 the EA adapts automatically to the rate between USD and the account currency.

4.6. Does the EA hold multiple positions at the same time?¶

tl;dr: Yes. The EA may open up to 2 positions in the same direction. Simultaneous shorts (max 2) and longs (max 2) are allowed.

Let me illustrate this with an example.

What we can see from the 15Minutes chart:

A new sell position was opened. The red check-mark symbolizes that the setup was also approved by the AI-module predicting it to be a Take-Profit result One hour later (four 15m candles) a new sell position was opened. The EA has detected a quick drop and decided to add another sell position. Only 15 minutes later, the small price reversal was detected and the EA decided to close the added sell position again to reduce the risk given the new situation. As it plays out, it was the right decision! The price went high and this closing saved us from a high drawdown.The loss was $10 Later, two buy-setups have been detected. These however where not confirmed by the AI-filter. So no buy position has been opened. Luck for us! The price reached the Take Profit level of our initial sell position and we closed it with profit $69.30. So after all, we ended up with a total profit for this trade of $59.